Trade is a complicated matter. With that being said, trade occurs between countries and countries benefit from the global trade system.

In a previous blog post on this site, I have stressed the importance of thinking in a 'global fashion' when discussing trade. The possibility of isolating certain imports/exports such as steel and aluminum is not possible without negatively impacting other traded products. In the blog post below, a few of the various 'connected' products which are being negative impacted (higher priced commodities) are highlighted below.

Warnings Before The Storm

Recently, there has been a considerable amount of news coverage concerning the trade tariffs which are being implemented by the Trump administration. The tariffs are supposedly under the umbrella of 'protecting national security.' Really? What is really at stake is the relationships that have been formed over decades of bilateral/multilateral agreements. Here are the latest few e-mails from 'Politico' news journal regarding the unfolding tariffs set to take place over the last few weeks.

According to '

Politico Energy' (last week Monday) China is planning on implementing tariffs on us too as shown below:

CHINA THREATENS ENERGY TARIFFS: The Beijing government released a target list Friday of 25 percent tariffs it says it is ready to impose if the U.S. carries out a second round of duties on Chinese goods. On the list, Pro's Ben Lefebvre reports, is a host of energy products, including shipments of U.S. oil, coal and petrochemicals. China is the third-largest customer for U.S. oil behind Mexico and Canada.

If the tariffs are enacted, U.S. oil exporters Exxon, Chevron and others would have to search for new customers, said Andy Lipow, president of consulting service Lipow Oil Associates. "China would have to buy additional quantities of oil from someone else, and the U.S. would have to look for new customers, presumably someone who lost sales from the Chinese," Lipow said. "But the imposition of tariffs can lead to a wider trade war, which ultimately slows economic growth around the world and reduces demand for fuel." More here from Ben, and more from Pro's Victoria Guida on the proposed tariffs here.

Following on Tuesday (last week), an email from '

Politico Energy' highlights OPEC and trade tariffs as shown below:

ON OPEC: Harold Hamm, founder and CEO of Continental Resources, canceled his scheduled appearance at this week's OPEC meeting in Vienna, a company spokeswoman told Reuters, saying the event didn't fit Hamm's schedule. But Reuters reports: "Hamm is the third of five U.S. shale executives to withdraw from a scheduled speaking slot at the OPEC meeting in Vienna." His withdrawal follows an intensifying trade dispute between China and the U.S., with China imposing $50 billion in tariffs on U.S. crude oil and other goods, Reuters reports. Continental has been a key supplier of crude oil to China — whose market may tilt toward OPEC suppliers in the absence of U.S. oil.

Separately, analysts at Goldman Sachs say they still expect oil prices to increase above $80 a barrel over the coming months, despite the trade tensions and concern over higher OPEC production, CNBC reports. The analysts said the possibility of OPEC producers announcing an increase to crude production levels could actually have a bullish impact on prices.

Ahead of the meeting: New analysis from French think tank Institut Français des Relations Internationales highlights 10 "OPEC+" oil producers and the extent to which they've been economically hit by lower prices. With the exception of Venezuela, leading producers managed to "navigate through the storm of lower oil prices" during the 16-month down market, but now may want to cash in and raise production, the analysis found. Read it here.

The two excerpts above now indicate that there is a greater threat to other relationships besides the trade partners in question - bilateral agreements. This further exemplifies that more 'goods' or 'products' are tied to one another. Then on Wednesday (last week), in an e-mail from '

Politico Agriculture', readers were given some insight into an exchange between Commerce Secretary Wilbur Ross and congressional leaders as shown below:

ROSS GETS EARFUL ON TRUMP TARIFFS: Finance Committee senators blasted Commerce Secretary Wilbur Ross on Wednesday for the damage done to the U.S. agricultural sector by foreign retaliation to the administration's steel and aluminum tariffs. American farmers "are bearing the brunt of retaliation for these actions," Chairman Orrin Hatch said during the hearing. "I just don't see how the damage posed on all of these sectors could possibly advance our national security."

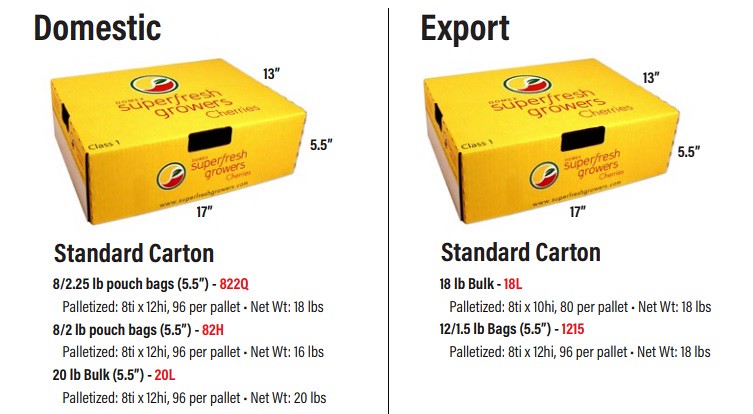

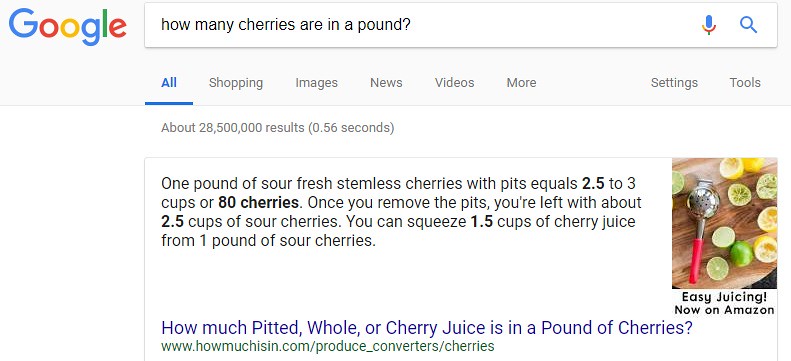

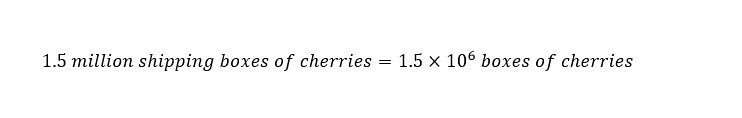

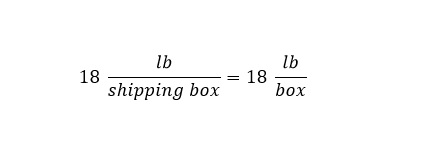

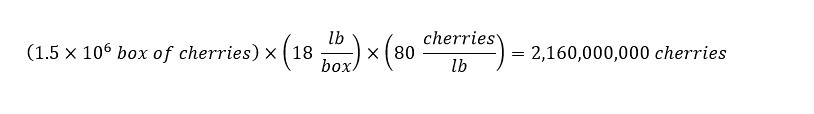

Warnings about economic harm: Sen. Ron Wyden (D-Ore.) cited complaints from Oregon potato growers and Pacific Northwest cherry growers "who have got nearly 1.5 million boxes of cherries ready to ship to China. They're worried those cherries are going to end up stuck on the dock or rotting in a warehouse due to China's retaliation,"

Not buying national security line: Sen. Chuck Grassley (R-Iowa) noted that market volatility can also make it more expensive for companies to invest in commodities to balance out the risk of other holdings. "I wish we would stop invoking national security because that's not what this is about," Sen. Pat Toomey (R-Pa.) said. "This is about economic nationalism."

The goal is more free trade: Ross said the administration has "no control over what another country does in retaliation," but argued the president's most recent threat to impose tariffs on another $200 billion in Chinese products was designed to discourage further escalation. The administration's aim, he said, is to have more free trade — not less. "The president's objective is not to end up with high tariffs, and his objective is not to end up in a trade war," Ross said. "His objective is to get to a lowering of barriers, both tariffs and non-tariff ones, and to protect intellectual property. ... The purpose of this is to get to an endgame that is much closer to free trade than what we've been before."

What about farmers? But Sen. Michael Bennet (D-Colo.) blasted Ross for not articulating a vision of how agricultural producers would be protected. "I don't think you're going to have any backstop for our farmers and ranchers, and to blindly pursue these policies without considering what happens to them I think is a huge mistake," he said.

Grassley wants nothing to do with handouts: Sen. Chuck Grassley had told reporters during his weekly ag briefing Monday that Trump pointed to Agriculture Secretary Sonny Perdue before telling a group of governors and congressional lawmakers that the federal government would subsidize any losses faced by farmers due to tariffs. "That's not what my farmers in Iowa want — help from the federal treasury," Grassley responded. He reiterated his displeasure about the idea to Ross at the hearing.

How can Commerce Secretary Wilbur Ross actually state with a straight face that the tariffs are designed to move the nation closer to 'free trade' than before? This does not make sense at all. Why? What the administration does not take into account is that the overall benefits of global free trade on all parties (nations) in the world?

In an earlier post, I pointed this obvious aspect out.

The current administration believes that the possibility exists to make money on free trade with tariffs. Over the last few weeks, threats have been made by other countries to level the playing field and enforce trade tariffs on exports/imports coming from the United States. The result will be the following as has been reported in the news so far as shown below:

1)

According to the New York Times,

nails used for construction will increase at least 20% in price, a 20% duty has been imposed by the European Union on

imported Whiskey from the U.S., a 25% tariff by China will be

imposed on Lobsters, along with unknown losses for both the

Peanut Butter industry, and

Cranberry industry.

2) According to economic analyst Steve Ratner on

Morning Joe, the price of soft wood lumber has increased 27%, which translates to the added cost of construction to a new home of around $6,388.

3) According to

USA Today, both the soybean market and aerospace exports to China will take a hit - which impacts farmers and aerospace industry. And Harley-Davidson Motorcycle corporation will move a portion of manufacturing overseas to avoid tariffs by other countries such as the European Union -- due to the tariffs imposed by the Trump administration.

None of the above bullet points highlight the obvious terrible fact that along with increases in prices of traded goods,

a corresponding loss of American Jobs will occur. The negative impact of the above tariffs is not enormous, but represents a loss to the revenue of our country. According to the

U.S. Department of Commerce, moves such as removing our nation from trade deals (i.e. NAFTA) could result in job losses of around 2.6 million American jobs. Wow.

In the reporting cited above, the potential trade war with China over around $50 billion is not huge, but is not necessarily preferred and will not result in any positive outcome for the United States. Additionally, a list of 180 types of products to which tariffs will be imposed upon can be found in the following article by NPR titled "

EU Tariffs Take Effect, Retaliating For Trump's Tariffs On Steel And Aluminum".

And finally, yesterday Monday, in an email from '

Politico Agriculture,' pork prices are due to increase in price by 20% on July 5 of this year:

TARIFFS PILE ON PORK INDUSTRY: Few industries have been hit harder by President Donald Trump's tariffs than pork, where producers have gone from predicting growth at the beginning of the year to worrying about losing market share in two of their three biggest markets, Mexico and China. Pork producers already took a blow in 2017 when Trump pulled the U.S. out of the Trans-Pacific Partnership, putting producers in an awkward position with Japan — the biggest importer of U.S. pork by value, according to the National Pork Board.

Pork has been targeted by tariffs at every step of the way, first showing up on a retaliatory list released by China after the Trump administration imposed $3 billion worth of duties on steel and aluminum in March. China is the third largest importer of U.S. pork, buying a little more than $1 billion worth of product in 2017. But producers are much more concerned about losing market share with our neighbor to the south. Mexico's 10-percent tariff on pork will jump to 20 percent on July 5, and the largest importer of American pork by volume is already in discussions with the European Union about ramping up cross-Atlantic imports.

The USDA's livestock, dairy and poultry outlook report released June 18 predicts hog prices are expected to average 19 percent lower in the third quarter and 17 percent lower in the fourth quarter, compared to prices from last year, in part due to price adjustments to Mexican tariffs.

Overall, in the excerpts above, the clear notion of a threat to our 'national security' is obviously not a true threat. Therefore, the trade tariffs imposed on other countries to overcome any threat to our national security is just a ploy (a trick) to build support among the citizens of the United States of America. Do not fall for the trick. Below, I want to discuss briefly, the indirect effect on business with China which has been reported but is not discussed widely in the news.

Storm Larger Than Predicted

The reporting over the last few weeks regarding trade would lead a person to believe that other countries will now need to 'pay their fair share' on traded imports/exports. That sounds wonderful in principle. With China having around $200 billion dollars in imported goods to the United States, the U.S. stands to get a good share of money from tariffs. While the United States has only about $50 billion in exports in return, the Chinese government appears to have less negotiating power. At first sight...

In reality, there is an entire other sector which is not classified as 'traded goods' as reported by NPR. Those goods or that category is 'services' -- i.e. the service industry along with the tourism industry. Businesses would love to expand their presence in China. The Chinese government could strike back and put restrictions on corporations which would have an unknown negative impact to the United States. The radio station NPR aired an episode titled "

What It Takes For An American To Do Business In China" in which the unknown threat was discussed as follows:

READE: Well, I hope the United States expected the response that they got because any China watcher would tell you that China will not want to come to a negotiating table from a position of weakness. China would definitely respond with an immediate and clear message.

KELLY: The Chinese cannot respond in kind, though, because the U.S. doesn't send $150 billion worth of goods to China, right?

READE: Correct, but the trade relationship is bigger than just the production and export of goods. There's a whole services side to the trade, and it's a number of things that you don't necessarily think about. So it includes tourism, which is in the billions of dollars. It also includes education.

The cumulative negative impact to the U.S. with regard to businesses trying to break into the Chinese market is unknown. Therefore, the current trade discussion is heating up and turning into a potentially problematic situation for both countries. Hopefully, in the months to come, congressional leaders step up along with large corporations and write/call President Trump and have him reverse the discouraging trade tariffs.

Conclusion...

Ultimately, the United States will suffer from the current move toward the trade imbalance being implemented by the Trump Administration. There is no sign of that occurring at the moment. The overall message coming out of the trade war is that trade is not a huge system of 'isolated components'. Each component is tied to each other. The analogy in medicine is that operating on one system in the human body does not impact any other anatomical/physiological system. Truth is that each component is connected in some fashion to another. Why would law makers, administrators think differently.

Last but not least, the real troublesome result of the ongoing breakdown of trade agreements is that deep relationships are broken or thrown into question between countries. Which is exactly what we (as a nation) do not want. Trust between nations is important. Imagine if you shopped at the farmers market every week. Furthermore, imagine if you could trust that each week a certain vendor selling a selective fruit/vegetable would definitely be there. The vendor depends on your business and you (as the consumer depend) on the vendor showing up with the produce that you desire to purchase. The relationship is built on trust -- really purchasing trust.

If no relationship exists, then the vendor has no reason to keep the prices the same or show up. As a result, you are impacted (cannot buy the produce that you would like) and the farmer/vendor cannot sell product. And the farmer's market association which hosts the market each week loses on the vendor's cut of the profits. Relationships breakdown and everyone loses. Lets not let that happen with other nations around the world.